Kalyan Jewellers (KJIL) listed on stock exchanges in March 2021. Despite a muted performance in CY21, the stock made a strong comeback in CY22, returning an impressive 85% for shareholders significantly outperforming key benchmarks.

KJIL Stock Performance:

After hitting low in June 2022, the stock has been on a roll. It’s worth taking a closer look at what’s driving this superior performance and considering the company’s prospects for future growth.

Quick Snapshot

Company Overview:

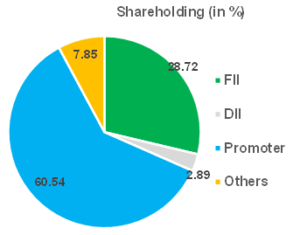

Kalyan Jewellers is a leading jewelry retailer in India, selling gold, silver, diamond, and platinum under various brands. It started in Thrissur, Kerala in 1993, and now has locations in India and the Middle East. The company was founded by Mr. T.S. Kalyanaraman, who is also the chairman, MD, and promoter. The chart below highlight the current shareholding pattern

Highdell Investments (an affiliate of Warburg Pincus, a private equity firm) owns ~ 26.36% in KJIL. Warbur Pincus made their first investment in KJIL in 2014 and then subsequently in 2017. They sold some of their holdings during IPO and now currently owns ~ 26.36% as per Dec’22 shareholding pattern.

As of H1FY23, Company has ~ 131 retail stores spread across India and ~ 31 showrooms in Middle – east. In addition to this, they also have ~ 881 “My Kalyan” Grassroot stores.

After establishing its footprints in South India, KJIL is now expanding its network in non-south Market. As per management, non-south markets have better margin and therefore this strategy should also improve the company’s return ratio which we will look at shortly in this note.

KJIL bought “Candere” in 2017 to target working women, and millennials. Presently, KJIL is offering its products online through Candere platform.

To ensure close customer connect and penetration in semi-urban and rural markets, KJIL launched “My Kalyan” centres. At present, there 881 My Kalyan centres. “My Kalyan” centres are part of the company’s strategic initiatives to promote “Kalyan” brand by connecting with customers on grassroot level. By opening “My Kalyan” centers near showrooms, the company is attracting customers in rural and semi-urban areas. The centers drive traffic to Kalyan showrooms, boosting overall sales.

Business Performance:

KJIL has 3 business verticals i.e India Business, Middle East, and Online Business.

India Business:

- Historically, KJIL had strong presence in South India, but now they are expanding into non-South market as well

- As of H2 FY23, 41% of Kalyan Jewellers’ stores were in non-South markets. The number of stores in India rose from 124 showrooms in FY21 to 132 (including 1 Candere store) as of H2 FY23

- KJIL witnessed healthy top line growth in their India business. Revenue for the quarter ending Sep’23 increased by ~4% qoq and 13% yoy. During the same period, PAT increased by 40% y-o-y and remained flat q-o-q

- The contribution of non-South markets to revenue increased from 29% in Q2 FY22 to 33% in Q2 FY23, aligning with the company’s strategy to expand in these markets.

- During H1Fy23, Company opened nine new stores

- KJIL plans to expand its store network through franchise route. They aim to launch 52 new stores in CY23

Middle East Business:

- Middle east business also reported healthy top line growth with revenue growing ~67% y-o-y and ~4% q-o-q

- The company opened only 1 store in the ME region in the last 12 months. Hence, the above growth is largely driven by the same store sales growth.

- KJIL has received interest from potential franchise partners, similar to its India operations. The company aims to launch franchise operations in the Middle East after establishing the first set of pilot showrooms in India.

- KJIL witnessed a strong 38% increase in revenue from the Middle East in FY22 compared to FY21. The region’s contribution to total revenue rose from 13.9% in FY21 to 15.2% in FY22

Digital Business:

- Candere.com is the company’s e-commerce site through which it reaches customers in India, US, and UK. Kalyan Jewellers acquired a majority stake in Enovate Lifestyles Private Limited, including its online platform www.candere.com, in 2017

- Candere is targeted to cater to tech-savvy customers and millennials.

- Candere saw revenue of INR 1,412 million for FY22, reflecting 83% CAGR growth since Kalyan Jewellers’ acquisition. Kalyan Jewellers opened its first physical Candere showroom as part of its growth strategy

Strategic Priorities: Vision 2025

The company has outlined its future plans and goals under the banner of “Vision 2025. The company aims for mid to high single digit growth from existing stores. In addition to this, they are looking to expand their store network aggressively primarily in non-south market.

In H1Fy23, the company launched 5 franchise showrooms in the non-south market and has plans for an additional 50 in the pipeline. According to their business update, their goal is to open approximately 52 new stores in India in CY23, primarily through the franchise route to efficiently expand their store network.

They have also laid down calibrated expansion plan for Middle east again through franchise route.

Financial Summary:

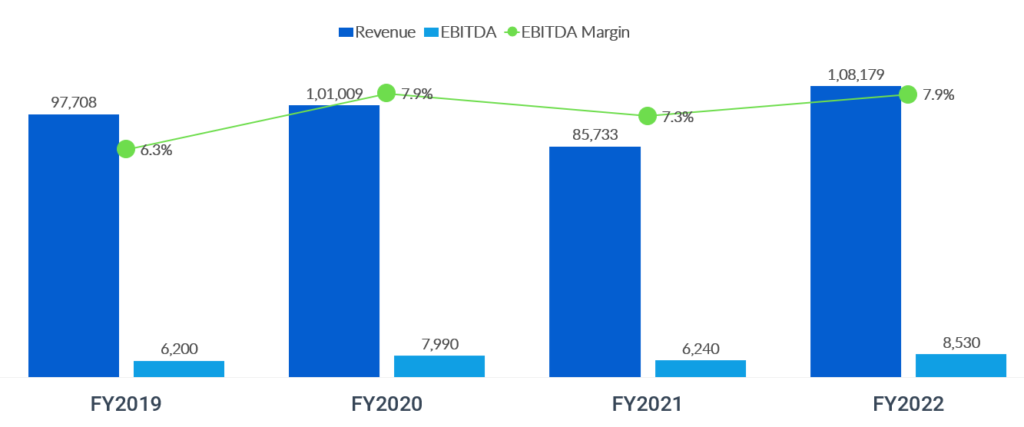

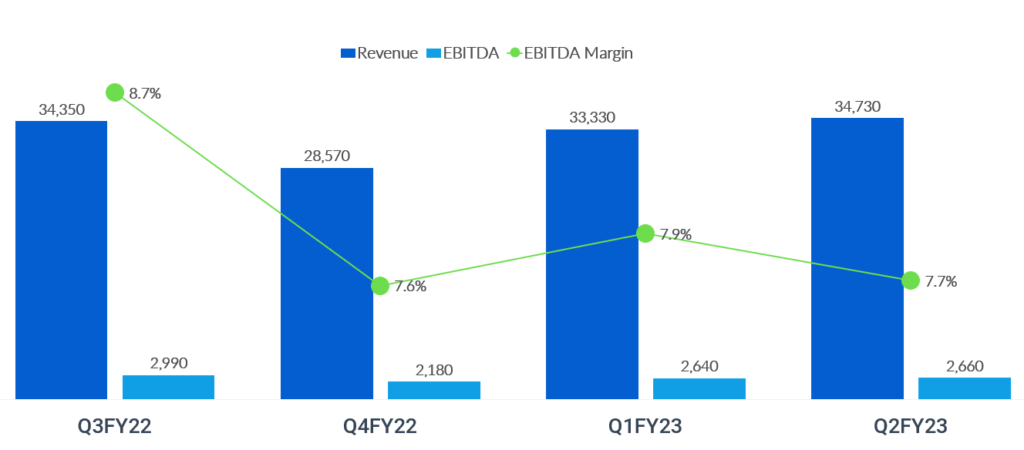

Revenue: Revenue was impacted due covid-19 pandemic in FY20 and FY21. In FY21, company also incurred a onetime loss of INR 900 M in middle east business. With the easing of lockdown, revenue jumped by 26% in FY22. On quarterly basis, Kalyan’s revenue has remained flat ~ INR 34,000 M. Dip in Q4Fy22 was on account of omicron outbreak

Margins: On an annual basis, KJIL’s EBITDA margin is around 6-8%. Management is targeting to improve its EBITDA margin to ~ 10% by FY25. The quarterly decline in EBITDA margin for Q2FY23 is on account of higher ad spending on Diwali campaigns. Also, in FY22 ad spends were comparatively lower due to covid-19

Key Financial Ratios:

- KJIL return profiles like ROE and ROCE have remained subpar. They incurred losses in FY19 (due to floods in Kerala) and FY21 (due to covid-19) resulting in negative ROE. However, going forward management has guided for improvement in return profile.

- As per company, all new company owned showrooms delivering RoCE more than 25% – Recently launched FOCO (Franchisee Owned Company Operated) model of franchised showrooms to help increase the pace of expansion both in India and Middle East in a more capital efficient return accretive path

- Divestiture of non-core assets as announced by the management should further improve return ratios

- Debt to equity has improved y-o-y. Company debt is primarily in form of short-term borrowings to meet its high working capital requirements.

Peer Comparison:

We are comparing KJIL with Titan as other listed gems and jewellery companies are relatively small and do not have Pan-India presence.

Titan clearly has superior operating metric on all parameters. However, Kalyan’s management has laid out an aggressive expansion plan which is expected to improve return ratios. This is one of the key things to monitor in Kalyan’s growth journey.

Valuation: The chart below highlights the current valuation multiples of KJIL and Titan

Valuation multiples of KJIL is at significant discount to Titan. If KJIL manages to get the execution right, we believe these valuation gap to contract.

Management:

Mr. T. S. Kalyanaraman is the current MD and founder of Kalyan Jewellers. He has 46 years of retail experience with 26 years in Jewellery industry. His sons Mr. Rajesh and Ramesh Kalyanaraman are Executive Directors in the Company.

Kalyan Jewellers has a board of directors comprised of 11 members, with 6 of them being independent directors. The total salary paid to the company’s directors (including Mr. T. S Kalyanaraman and his sons) for FY22 was approximately INR 181.8 million, which is around 8% of their FY22 profit after tax (PAT).

Outlook

The jewelry retail industry has favorable long-term potential. The trend of transitioning from unorganized to organized players is expected to continue in the coming years, and well-established brands like Titan and Kalyan are poised to reap the benefits.

KJIL’s approach to expanding its network through an asset-light strategy is favorable from a shareholder’s perspective. With only a 6% share in the organized jewelry segment, there is an opportunity for KJIL to capture a larger share of the market from unorganized players.

Its expansion plan along with the favorable industry outlook and reasonable valuation make it a worthwhile investment for long-term portfolios. All this provided company management delivers on the proposed expansion strategy.

Disclaimer:

The above article is just for information purposes and shouldn’t be considered as any investment or trading advice.