Introduction: Angel One Business Overview

Angel One Limited (“Angel One”, formerly known as Angel Broking Limited) was established in 1996. The company is a member of the Bombay Stock Exchange, National Stock Exchange of India, National Commodity & Derivatives Exchange Limited, and Multi Commodity Exchange of India Limited. Angel One is a depository participant with Central Depository Services Limited (CDSL). The company provides broking services, margin trading facility, loan against shares, and other financial services.

Angel One (erstwhile Angel Broking) transformed from a full-service broking firm to a digital fintech platform in 2020. The company rebranded itself as Angel One, a ‘Digital First’ brand that serves all the financial needs of its clients. It has now positioned itself as a technology-led financial services company providing broking and advisory services, margin funding, loans against shares, and other financial services. Its key competitors include other discount broking firms like Zerodha, Groww, Upstox etc. The company is considered a rising star in the Next 500 Fortune India List for 2022

Business Segments

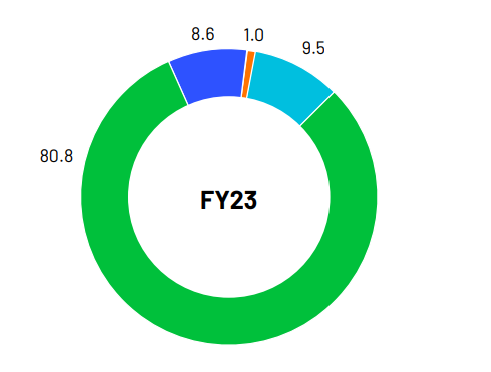

Angel One has 3 main business segments as highlighted below:

- Broking and Depository Operations: The company provide broking services, across equity (cash-delivery, intra-day, and futures and options), commodity, and currency segments along with depository operations through their Super App, web platform, and desktop application. This is their main business segment and contributed ~ 81% of the gross revenue in FY23

- Client Funding: Angel One offers margin trading funding to our clients for up to 80% of the purchase value of equities in the cash delivery segment. This segment contributes ~ 9% of the gross revenue

- Distribution of third-party financial products: Angel One is also the distributor of third-party mutual funds, IPOs and bonds, along with life and non-life insurance products through their wholly owned subsidiary. This segment is relatively small and contributes only 1% to the gross revenue

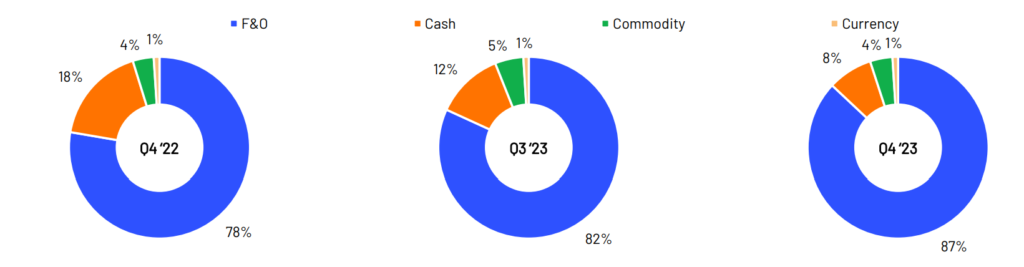

F&O segment is the major contributor to the broking revenue as is the case with other discount broking firms. F&O contribution has increased from 78% in Q4FY22 to 87% in Q4FY23 due to increasing retail participation in derivatives segment. NSE now has 4 weekly expiry days (Tuesday: FINNIFTY, Wednesday: MIDCAPNIFTY; Thursday-Nifty50 and Friday- BankNifty (from Jul’23 onwards). In addition to this, BSE also has SENSEX and BANKEX expiry on Friday.

F&O trading is highly speculative, and it is to be seen if this growing trend of F&O trading will sustain or not. However, with more option expiry days every week, volume from existing active traders should grow and this will benefit players like Angel One.

Market Share Trend:

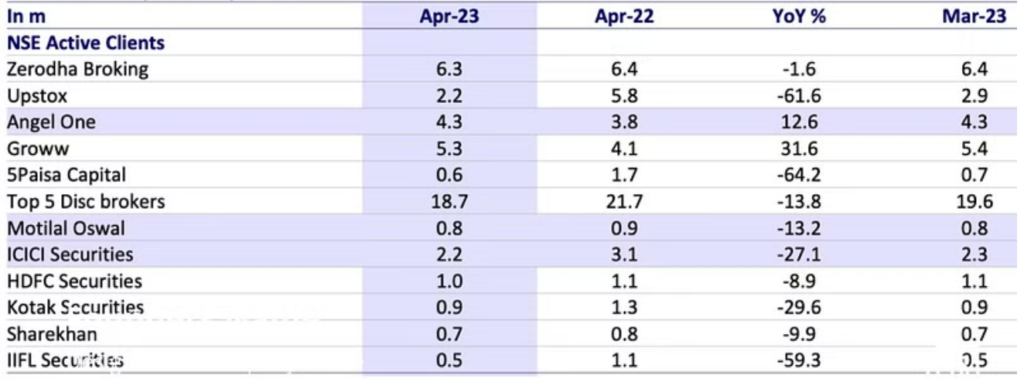

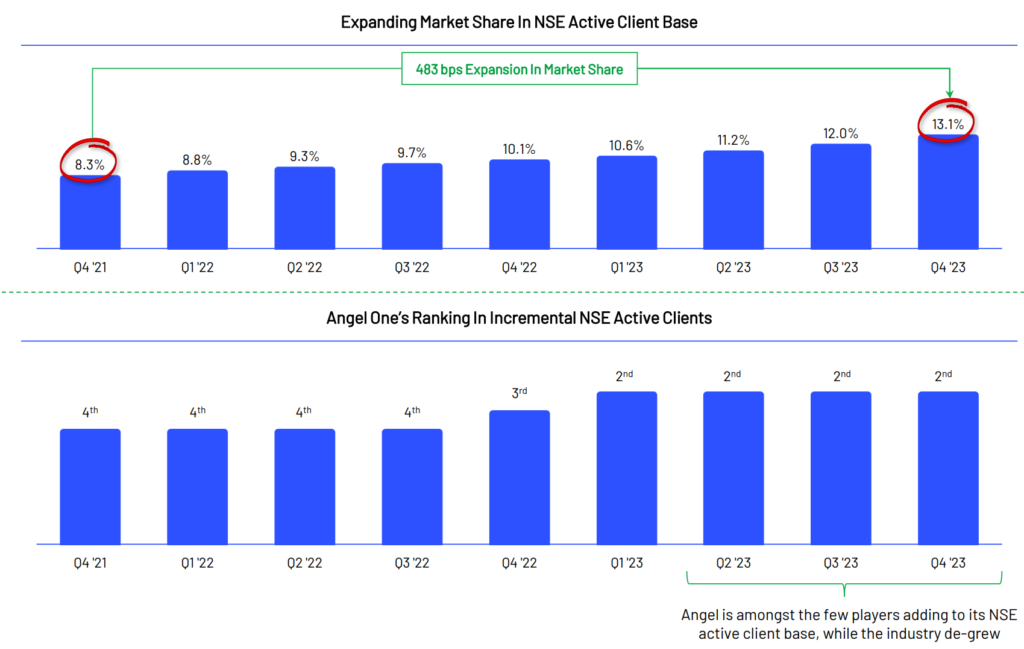

In last 1 year, Angel One and Groww are the only 2 broking firms which has seen their market share increase in NSE Active Clients. Most broking firms including market leader zerodha have seen a decline in their market share.

In fact, Angel One has consistently gained market share in NSE active clients every quarter (ref. chart below)

Angel One: Financial Performance

Angel One is one of the largest stock broking companies in India in terms of client base. As of March 31, 2023, the company had a customer base of over 12.8 million. Angel One is also one of the fastest-growing stock broking companies in India. In the last fiscal year, the company’s revenue grew by 21.93% and its profit after tax grew by 30.81%. The strategy to transform its existing business to a complete digital fintech platform has worked well for the company. In the last 4 years, the company has seen significant improvement in its financials on account of this transition.

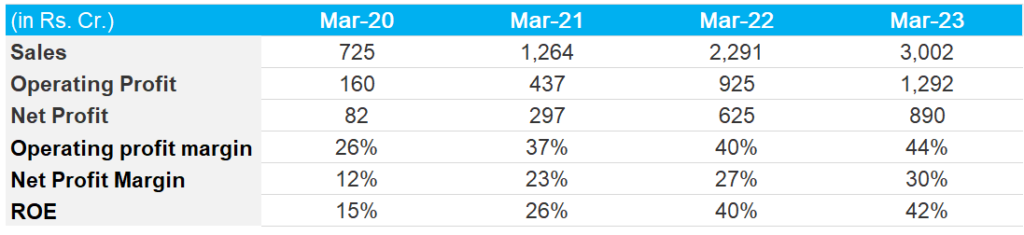

Annual Financials: The table below summarizes the key financial data for the last 4 years.

- Angel One’s revenue and net profit have grown at an impressive CAGR of 61% and 121% respectively during Mar’20 to Mar’23. While revenue has increased 4x, its net profit has jumped by ~10x

- Operating Margins: Angel One has seen consistent improvement in its operating margins from ~26% in FY20 to ~44% in FY23.

- Return on equity: In line with improvement in operating margins, ROE has also improved from 15% in FY20 to 42% in FY23

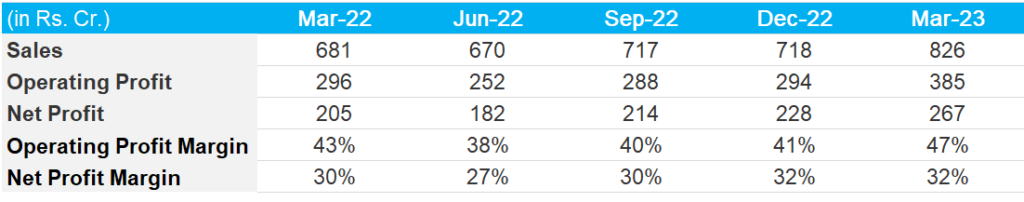

Quarterly Financials

- On a quarterly basis also, Angel One reported good numbers. In Q4FY23, its sales increased by 15% q-o-q and 21% y-o-y.

- Operating margin in Q4FY23 also expanded by 600 bps to 47% as compared to 41% in Q3FY23.

Business Outlook

Angel One has completed its transition to Super App and there are no more investments required for Super App. The management aims to leverage their Super App to develop innovative solutions, which will help in unlocking future growth opportunities. Angel One is also looking to increase its distribution income, which currently stands at only 1% of the gross revenue. The company also received in-principal approval as a sponsor for mutual funds. As per management it will take at least six quarters to launch the schemes.

Angel One is well positioned to benefit from the long-term sectoral tailwind of financialization of savings. With a greater number of options expiry days per week, derivatives volumes are also expected to increase. This should benefit the broking firms like Angel One.

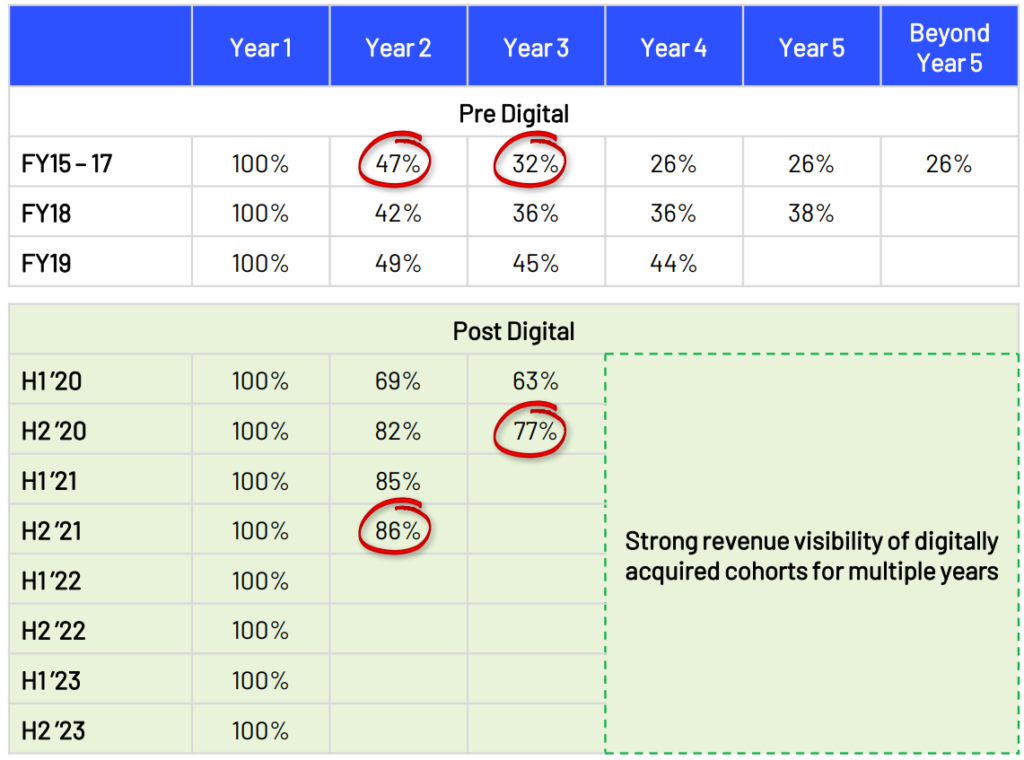

The management emphasizes that the transition to a digital model has significantly improved customer revenue progression. Previously, the revenue generated in Year 2 and Year 3 accounted for only 47% and 32% respectively, compared to the initial income acquired from customers in Year 1. Post transition to digital model, Year 2 and Year 3 revenue has jumped to 86% and 77% respectively (Refer table below).

This provides better revenue visibility. The cyclicity factor associated with such business may no longer be the case and these digital fintech broking companies may command better valuation.

Valuation and Peer Benchmarking

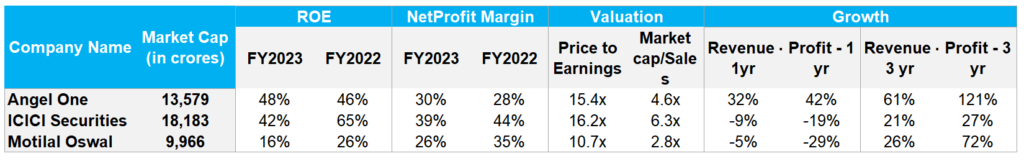

We compared Angel One with other listed midcap broking firms like ICICI Securities and Motilal Oswal. The table summarizes the key operating highlights along with their historical valuation.

Angel One clearly has superior operating and growth metrics. Both ICICI securities and Motilal Oswal witnessed de-growth in top line and bottom line in FY23. Angel One on the other hand reported healthy growth of 32% in revenue and 42% in net profit in FY23. While Angel One income is primarily concentrated in one business segment, ICICI Securities and Motilal Oswal has slightly diversified revenue stream. The current dividend yield of Angel One is ~ 2.45% while that of ICICI securities is 4.25% and that for Motilal Oswal is ~1.5%.

Angel One currently trades at 15.4x price to earnings and 4.6x Market Cap to Sales. With favourable sectoral tailwinds, and business now being more of an annuity kind of business, we believe Angel One deserves higher multiples.

Assuming a 20% CAGR growth in net profit for the next 2 years, we expect Angel One to report an EPS of INR 154 per share (FY23 EPS was 107) in FY25. Assuming price to earnings multiple of 15x (i.e no re-rating), Value per share works out to be ~ INR 2300 which is ~42% upside from current price of ~ INR 1622. Note that Angel One has reported healthy growth even in a subdued market environment i.e during FY23.

Conclusion

Currently, Angel One is well placed to seize the long-term opportunity of financialization of savings. This is also evident from the fact that they have acquired many of their new customers from Tier 2 and Tier 3 cities. In fact, in FY23, the share of tier 2 and tier 3 towns in its gross customer additions surged to 94% in FY23.

With the new Super App, the company now has better capabilities to leverage the opportunity ahead. The company is also looking to diversify its revenue by increasing its share of distribution income. With better revenue visibility from the customers acquired through digital channels, the business has lesser elements of cyclicity as compared to the pre-digital period.

Given the above factors, industry leading growth and reasonable valuations, we believe this could be a good addition to a long-term portfolio.

Disclaimer: This article is only for information and should not be considered as any investment advice. We may have positions in these stocks in our own portfolio or have recommended it as part of our advisory services.