Kabra Extrusion Technik Limited (KET) is a small-cap company with a market cap of approximately INR 1900 crores. Founded in 1984, KET is a top manufacturer and supplier of plastic processing machinery, including twin screw extrusion lines and single screw extrusion lines. Since entering the EV battery business in 2018, KET has experienced strong growth. In this article, we analyze KET’s business and future plans, particularly in the EV segment.

Quick Snapshot:

Company Overview

KET is a part of the Kolsite Group, which began operations in 1962. The group comprises four flagship companies that specialize in various fields, including Extrusion Machinery, Masterbatches, Secondary Packaging, and Agency Work.

Kolsite Group Of Companies

- Kabra Extrusiontechnik Limited (KET)

- Plastiblends India Limited (PBI) – listed entity (market cap ~426 crores)

- Maharashtra Plastic & Industries Limited (MPI)

- Kolsite Corporation LLP – Agency Division (KCLLP)

Mr. Shreevallabh G. Kabra is the founder of the Kolsite Group of Companies.

Promoters (Kabra family and Kolsite group companies) own ~ 60.23%. Latest shareholding is as below:

Business Overview

KET has 2 main business verticals i.e Extrusion Machinery Business and Battrixx.

Extrusion Business:

KET is a well-established player in the extrusion machinery industry, currently holding a market share of approximately 40% as of FY22. The company has a presence in 92 countries and has successfully installed over 15,000 extrusion lines. Its product range includes blown film lines, pipe extrusion lines, sheet extrusion lines, compounding lines, and auto-feed systems, with various applications in the packaging, infrastructure, construction, and telecom industries. KET has technical tie-ups with following European companies:

- Battenfeld Cincinati: Technical tie-up with Battenfeld-Cincinnati since 1983 for pipe and profile machinery

- Extron Mecanor: JV with Extron Mecanor, Finland in October 2016 to provide an integrated approach to pipe producers by offering pipe socketing and belling solutions

- Penta SRL: A 50:50 JV with Penta SRL, Italy for auto-feeding systems for the plastics and food processing industry

- Unicor Gmnbh: Technology partnership since Oct’16 for making corrugated pipe machines

This division contributes ~ 44% of total revenue of KET (based on 9M FY23 financials)

The Company operates Research and Development Laboratories in Kachigam and Dunetha, Daman, which are equipped with in-house quality control and testing facilities. These labs are recognized by the Department of Scientific and Industrial Research, Ministry of Science and Technology, Government of India.

Battrixx Business:

Battrixx is KET’s future technologies division, specializing in the development and production of green energy systems and solutions. Established in 2018, the company has partnered with a reputable European firm to leverage patented design and manufacturing processes. Battrixx offers lithium-ion battery packs with a smart Battery Management System (BMS) for electric vehicles and other energy storage applications

The battery value chain involves multiple processes, ranging from component manufacturing and cell production to reuse and recycling. KET’s primary focus lies in module production, pack assembly, and vehicle integration, as illustrated in the chart below.

Module production involves assembling battery cells into larger units that are critical for performance and safety in a battery system by providing electrical connections and heat distribution.

Pack assembly involves putting together battery modules to form a battery pack, the final product that provides energy storage for various applications, such as EVs, renewable energy systems, and consumer electronics.

Finally, integrating a battery pack into a vehicle involves connecting it to the vehicle’s power and control systems to ensure seamless operation. This is crucial in electric and hybrid electric vehicles

KET aims to become a leading platform for battery packs and has been investing in R&D to maintain a competitive edge in technological advancements.

Battrixx has acquired 100% stake in Pune-based Varos Technology to develop end-to-end battery management systems. By utilizing cloud-based Artificial Intelligence (AI) driven analytic tools, the acquisition aims to predict battery life and monitor battery performance.

The company collects data from its battery packs and utilizes it to design more efficient battery packs, resulting in enhanced product experience and quality. With an increasing customer base, more data is collected, enabling further improvements to the product offerings through a continuous feedback mechanism.

KET has an in-house R&D center and manufacturing facility located at Chakan, Pune, dedicated to designing, developing, and producing Lithium-ion Battery Packs.

Battrixx division of KET is seeing robust growth. For the quarter ending Q3FY23, revenue of this division jumped ~218% yoy. As of H1FY23, Battrixx has 15% market share in the lithium-ion batteries. This division contributes ~ 56% of total revenue of KET (based on 9M FY23 financials).

In Q3FY23, Battrixx partnered with Hero Electric to launch “Ultra Safe” battery packs for their electric two-wheeler range. Hero Electric has projected that Battrixx will supply 300,000 battery packs and chargers by FY24. KET aims to expand its presence in the electric three-wheelers, four-wheelers, and electric light commercial vehicle segments in the near future, as per the management’s plan for Q1FY24.

Govt. mandated AIS 156 Phase I from Dec 2022 to ensure safety for EVs in India. It covers safety standards for EV components such as battery systems, electric drivetrains, charging systems, and vehicle structure & crashworthiness.

Battrixx adopted AIS 156 compliant battery packs since inception, positioning the company to easily transition to the Government’s safety norms and meet OEMs demand. The company views this as a critical step towards enhancing EV battery quality, design, and safety. According to management, the new safety standards will strengthen the value proposition of organized players by serving as an entry barrier.

Expansion Plan:

In Dec’21, the board of Kabra Extrusion Technik Ltd approved a proposal to raise up to ~INR 300 crore for the expansion of its future technologies brand Battrixx. Of this, ~INR 100 crore shall be funded via equity while the balance INR 200 crore shall be funded via debt from financial institutions. This will enable Battrixx to enhance its annual production capacity in phases from the existing 100,000 battery packs to 700,000 by the end of FY24, to meet the growing demand in the electric vehicle industry and other energy storage applications.

Promoters have subscribed to warrants worth approximately INR 100 crores to fund the expansion of Battrixx. As part of this commitment, a small portion of warrants (6%) was converted into equity in FY22, leading to an increase in share capital.

Financial Summary:

Revenue & Profitability:

KET achieved a record revenue of INR 4,059 million in FY22, with significant contributions from both extrusion and Battrixx businesses. Battrixx’s contribution to total revenue increased from approximately 1% in FY21 to around 26% in FY22. In the first nine months of FY23, KET has already exceeded its FY22 revenue, with Battrixx contributing over 56% of total revenue, surpassing the extrusion business.

Despite impressive revenue growth, KET’s EBITDA and PAT margins have been declining, which the management attributes to high raw material costs and changes in the product mix. The Battrixx business became profitable only in Q4FY22, and the PAT margin has been further impacted by higher interest expense due to increased debt funding for ongoing capex.

The increasing contribution from the Battrixx business has led to an improvement in margins over the last two quarters, as shown in the chart below. Management remains optimistic about the prospects of this segment and expects it to continue to see high growth.

Key Ratios:

KET’s debt has increased to fund the expansion plan as mentioned above. Interest coverage continues to be quite comfortable.

Its return ratios, such as return on capital employed (ROCE) and return on equity (ROE), have remained in between 10-15%, which is acceptable. KET’s business got lot of operating leverage and with increase in sales (which is expected given the momentum in EV business), return ratios could improve going forward

Cash Conversion:

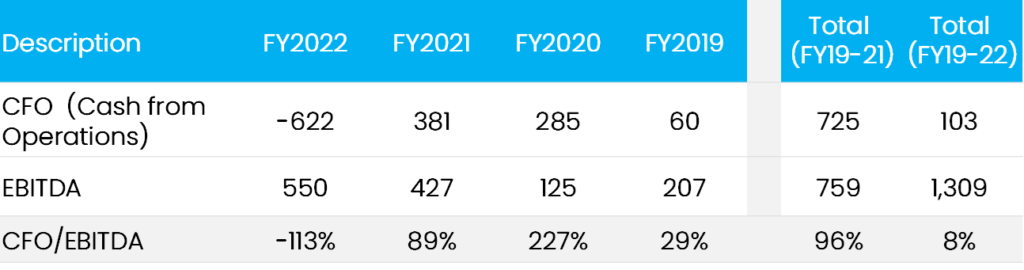

In FY22, KET’s operating cash flows turned negative due to a significant rise in the company’s working capital requirements, with net working capital increasing by approximately 148% from INR 613 million to INR 1,519 million. The increase is mainly attributed to a rise in inventory, primarily raw material. While this is a normal practice for companies to stock up in anticipation of higher demand, it has negatively impacted KET’s cash flows. However, the company has witnessed healthy top-line growth in the first nine months of FY23.

Cumulative operating cash flows to EBITDA for 3 yr (i.e FY19-21) is ~ 96% implying KET is able to convert its operating income to cash.

KET’s cash conversion cycle has remained flat y-o-y but has improved from 200+days seen during FY19 and FY20.

Management

Mr. Shreevallabh G Kabra is the chairman and managing director of KET. He is the founder of Kolsite group of companies. He has done BA in Economics (Honours) from Mumbai University.

Mr. Anand Kabra is vice chairman and MD at KET. He is a mechanical engineer from Mumbai University. and a MBA from S P Jain’s Institute of Management and Research. He has also completed the Owners President Program (OPM) from Harvard Business School.

Ms Ekta Kabra looks after the overall strategy. She has over 20 years of experience. She holds a bachelor’s degree in economics and management from S.P. Jain

Total compensation to the directors for FY22 was ~ INR 33.5 M which is ~ 11% of net profit for FY22 which is high. Moreover, there has been steep jump in the salary of directors as highlighted below:

Peer Comparison and Valuation

We are benchmarking KET with other battery manufacturers like Amara Raja and Exide Industries. KET has similar operating parameters to peer companies (except for a higher cash conversion cycle). Stock is currently a little expensive at 2.2x PEG.

Outlook

During 2015-2021, EV sales grew at a compounded annual growth rate of ~95% due to government incentives under FAME-I (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) and FAME-II, as well as a reduction in GST rates from 12% to 5%. Despite this, EV penetration in India is still at a nascent stage, accounting for only 1% of total vehicle sales in CY21. However, it is expected to account for 39% of total automotive sales by CY27, indicating significant growth potential. This growth is also expected to boost battery demand, as shown in the chart below.

On the back of this favourable industry dynamics, Companies in the Battery value chain like KET is expected to benefit. Management has maintained their positive outlook, especially in the EV space. They have guided for robust growth to continue in this segment. Ongoing capex will support this growth in demand.

KET’s entry into the EV market in 2018 appears to be working well. While KET currently has only 15% market share in the E2 wheeler space, they plan to expand into E3 and E4 wheelers. The company’s strong performance in executing their strategy is evident in their stock price and valuation. As EV adoption grows, KET can gain market share in multiple categories. However, with the current valuation being high, investors may want to wait for a market correction or dip to consider entering.

Technically, the stock is in a strong uptrend, with the price above key indicators like the base line, conversion line, and kumo cloud, while the future kumo is trending up. Recently, it has crossed the key pivot level of ~570 with higher volumes, and the next resistance level is at 650, which, if breached, may lead to further upside. Therefore, any dip towards 570 can be seen as an entry opportunity from a technical perspective.

Disclaimer: The above article is just for information and should not be considered as any investment advice.