QSR (Quick Service Restaurants) companies like Jubilant Foodworks, Devyani International, Sapphire Foods have corrected significantly from their highs. However, they have covered some lost ground post the market rally that began in late March’23. In this article, we will evaluate if there is an investment case in these QSR companies. If yes, which one offers better risk reward? Is it just the market rally or is it sustainable and these QSR companies can create significant value from hereon. All these QSR companies are well known and therefore we will not go much into their business details in this article. We will focus more on the business outlook of these QSR companies and underlying demand and relative valuation. For this article, we have considered 3 QSR companies i.e Jubilant Foodworks, Devyani International, Sapphire Foods.

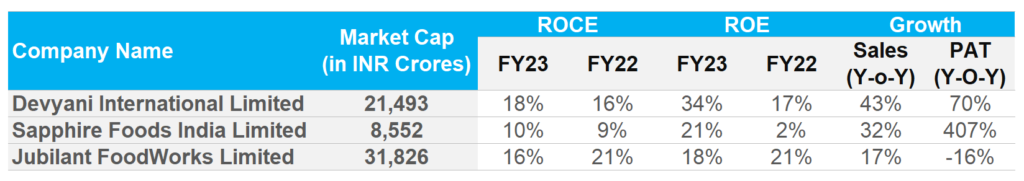

The table below summarizes the quick overview of how these companies stand as of now.

Let’s look at each of these companies. We will analyze the recent quarterly performance as well as the business outlook.

Devyani International

Devyani International (“Devyani”) is the largest franchisee for Yum! Brands in India, operating over 1,100 KFC and Pizza Hut restaurants. The company also operates Costa Coffee stores in India and Nepal. Devyani International has a strong presence in the food retail business, with over 100 Food Courts in India. The company is also expanding its international business, with operations in Nigeria and Nepal.

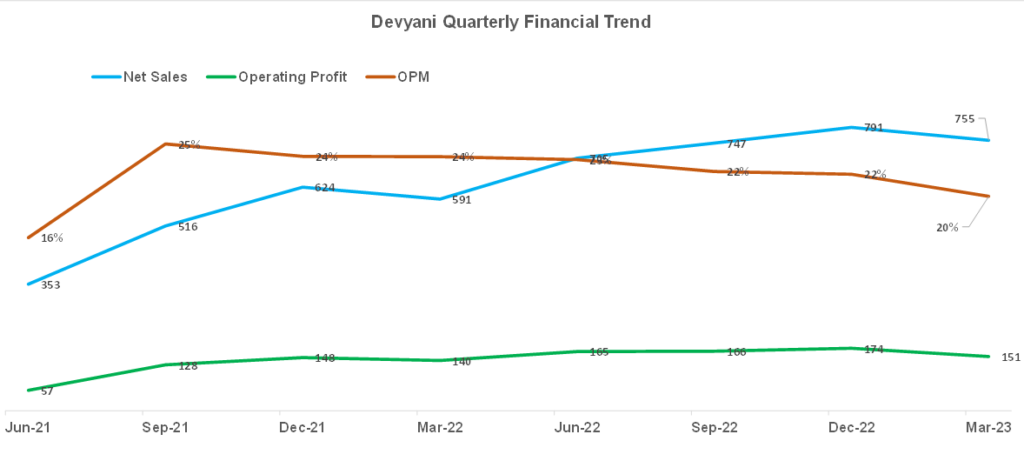

Over the last 8 quarters, Devyani’s revenue has been steadily growing (blue line in the chart below). However, this is not translating into bottom line growth due to rising input costs primarily in milk and cheese. Chicken prices have cooled off in the last quarter. There were some concerns around urban consumer demands as well due to inflation. Due to raw material inflation, the company’s operating margins have been under pressure. Operating margins have fallen from peak margin of 25% in Sep’21 to ~20% in the quarter gone by i.e Mar’23. However, despite this, the company reported good numbers for FY23 with a revenue growth of 44% and PAT growth of 70%. This growth is also due to lower base in FY22 on account of covid in the first half of FY22. In last 6 quarters there have been no improvement in operating profit

Business Outlook for FY24: Devyani plans to add around 300 stores in FY24, with a broad split of ~100 for KFC, ~100 for Pizza Hut, and 60-70 for Costa and the rest for smaller brands and international operations. The company has onboarded Pizza Hut on the ONDC platform and is working on integrating all other brands. They also took price hike of 3-3.5% for KFC in Apr’23. As per management, input cost inflation to bottom out over the next few quarters and consumer sentiment to improve. Hence, the operating margins should start improving from hereon and this should help with bottom line growth. With valuation now being more reasonable, Devyani offers a good entry opportunity for long-term investors.

Sapphire Foods India Limited

Sapphire Foods India Limited (“Sapphire”) is one of the largest franchisees of Yum Brands Inc in the Indian subcontinent. The company owns and operates more than 400 KFC, Pizza Hut, and Taco Bell restaurants across India, Sri Lanka, and the Maldives. Sapphire Foods has a strong track record of growth and expansion. In the past five years, the company has opened over 200 new restaurants and increased its revenue by over 50%.

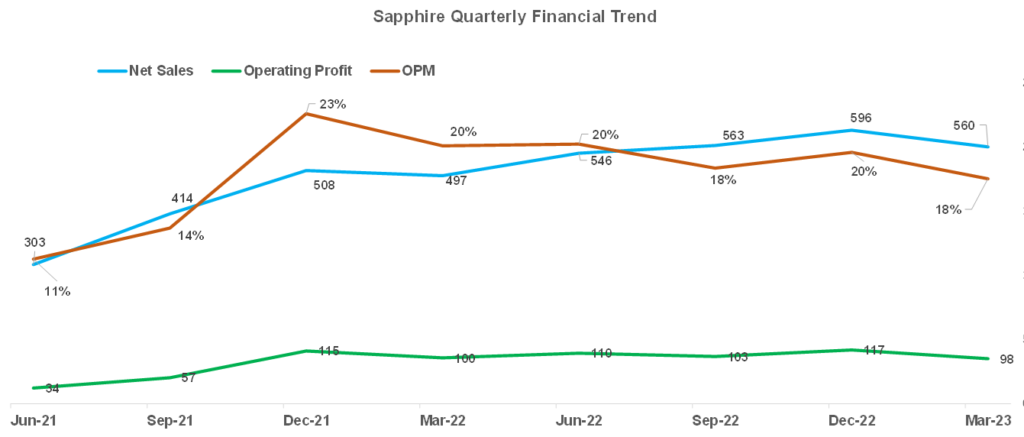

Similar to Devyani, Sapphire also witnessed decent topline growth in revenue over the last 8 quarters, but operating margins declined. Revenue in the last four quarters has remained flat, implying demand pressure as well. Sapphire business was also impacted because of economic crisis in SriLanka. From peak margin of 23%, Sapphire reported an operating margin of ~18%.

On an annual basis, Sapphire also reported good topline growth of ~32% in FY23. In PAT figures, there is an adjustment for deferred tax credit in FY23 because of which PAT growth is showing as 407%. However, even after adjusting for this, company reported an impressive PAT growth of 207%. Similar to Devyani, high Y-o-Y growth is due to the low base of FY22 due to covid-19. Operating profit remained nearly flat for last 6 quarters.

Business Outlook for FY24: While management has not provided any specific guidance for FY24, they have reiterated their long-term store expansion guidance of doubling the store network from Dec’21 base (which is ~ 482 restaurants). This translates into the opening of 130-160 new stores per year.

Jubilant Foodworks

Jubilant Foodworks Limited (“Jubilant”) is an Indian quick service restaurant company headquartered in Noida, Uttar Pradesh. It is the largest franchisee of Domino’s Pizza in India, Sri Lanka, Bangladesh and Nepal, operating over 1,800 Domino’s Pizza restaurants. The company also has exclusive rights to develop and operate Dunkin’ restaurants in India, Popeyes restaurants in India, Bangladesh, Nepal and Bhutan, and Hong’s Kitchen restaurants in India

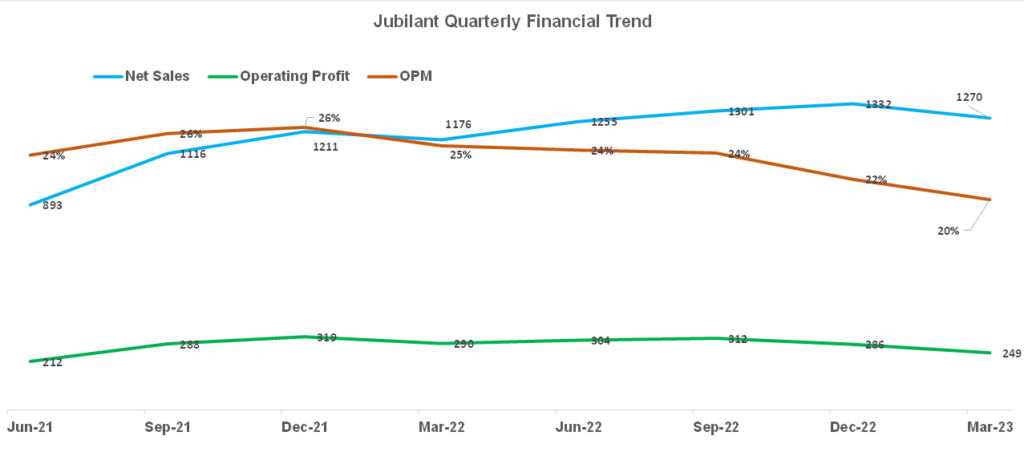

Jubilant was the most affected QSR stock. While Devyani and Sapphire witnessed good y-o-y growth, Jubilant reported a decline in Y-O-Y profits. In terms of price performance also, Jubilant disappointed the investors. During FY22-23, there was a management change as well in the case of Jubilant, which also impacted sentiments. The quarterly financial trend is nearly same as Devyani and Sapphire as highlighted above.

Business Outlook for FY24: The company plans to open 200-225 new Domino’s India stores and 30-35 new Popeyes stores in the next year. Capex guidance for FY24 is expected to be ~ INR 700-800 crores. As per management, the current demand slowdown is transitory and therefore they continue to invest in their business. During the year, Jubilant launched a new 20-minute delivery service which is seeing positive results. Like Devyani, Jubilant is also planning to launch its brand on ONDC platform. The company is working on optimizing its costs to ensure EBITDA margin is sustained in case of no improvement in like for like growth. Management has not provided any guidance on margin trajectory. Also, they have not guided as to when same store sales growth will turn positive.

Valuation

Except Jubilant, both Devyani and Sapphire have given good returns in the last 12 months. Valuations of all these three companies are now at more reasonable levels. Devyani is trading at premium to both Jubilant and Sapphire due to its healthy return ratios and growth outlook. Between Sapphire and Devyani, Devyani is expected to trade at premium given its better return ratios compared to Sapphire and similar growth outlook.

Jubilant on the other hand is trading at discount to Devyani. Infact, Jubilant is currently trading below its 5-year median valuation multiples. Given the strong past track record of capital allocation and earnings growth, a mean reversion trade is quite possible in case of Jubilant. We believe both Jubilant and Devyani are on equal footing in terms of fundamentals and growth opportunities and therefore both these companies should trade at similar multiples while Sapphire should continue to trade at a discount to both these companies due to inferior return metrics.

The valuation multiples can be really misleading at times. So, we tried to do a conservative DCF (5 year) Projections for all three companies. The idea was to evaluate the margin of safety at current prices. If the growth kicks in on the backdrop of inflation cooling off and revival in demand, we can benefit from good upside. Here is the summary of DCF valuation along with assumptions and final outcome.

Assumptions: We made following growth and ROC assumptions for these 3 companies

Rationale: Devyani had negative EBIT till FY21 while Sapphire had negative EBIT till FY22. In FY23, EBIT for Devyani jumped 60%. Sapphire also turned EBIT positive from loss. So, for the next 5 years we have assumed an EBIT CAGR of 20%. FY23 return on capital for Devyani was ~18% while that for Sapphire was close to 11%. ROC is expected to improve so for sapphire we have assumed a 15% ROC while for Devyani we have considered 18% only (conservative assumption).

Last 5-year EBIT CAGR for Jubilant was ~19%. So, for the next 5 years we conservatively assumed 15%. Jubilant has had a healthy ROC of more than 20% in the past. For our DCF working we have assumed 20% ROC for Jubilant.

Terminal growth rate for all the three companies is assumed at 12%.

For WACC (weighted average cost of capital) calculation, we assumed Risk free rate of 7% (close to 10-year g-sec yield), market return of ~13% (10-year Nifty CAGR). Cost of debt is the actual interest cost assumed for these companies and the capital structure is expected to remain the same as in FY23. If the interest rate falls (which is quite possible now), the WACC should reduce, and this should further uplift the valuation estimates.

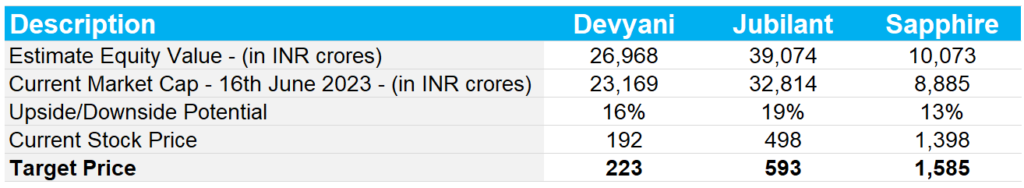

With the above simple and conservative assumptions, intrinsic market value of each of these 3 companies are as follows:

Note: The objective of DCF is never to get a precise value but to evaluate the margin of safety. One can further fine tune the model based on company specific expansion plans etc. DCF is extremely sensitive to tenor and interest rates. So, a 10-year DCF would give widely different results.

Conclusion

We are overall quite positive about QSR space, and we believe there is a good growth runway for these QSR companies. While the products of these QSR companies may not be good for health, they could be a healthy addition to an investment portfolio.

In terms of pecking order, our first preference is Devyani followed by Jubilant and then Sapphire. Devyani is part of Jaipuria family group. The other listed company of this group is Varun Beverages which has been a big wealth creator. We like the management track record and their ability to scale up the business. Jubilant also has an excellent track record. Inflation is cooling down and we may see a rate cut by RBI later this year. This should boost discretionary consumption and Jubilant could be a big beneficiary given the valuation comfort. Key thing to track in case of Jubilant is how the expansion of Popeyes store pans out. There is a good margin of safety at current prices and therefore we suggest investor to consider adding these companies in their long-term portfolio

Disclaimer: This article is only for information and should not be considered as any investment advice. We may have positions in these stocks in our own portfolio or have recommended it as part of our advisory services.