Rajratan Global Wire Limited (“Rajratan”, “Rajratan Global”) is an Indore-based company focused on manufacturing and selling tyre bead wire. After hitting its lows during the COVID crash, the stock had a dream run. Rajratan Global’s stock price rallied from a low of INR 37 to INR 1400 in September 2022, making it 30x in approximately two years’ time. After reaching its high of 1,400 in September 22nd, the stock has now corrected by almost 50%. In this article, we will evaluate the reasons behind this correction, what lies ahead, and whether this correction is an opportunity for long-term investors or not.

Company Overview

Raj Ratan Global Wire Ltd. started out in 1989 as Raj Ratan & Co, a partnership dealing in steel wires & rods. By 1995, company had expanded its operations to manufacturing of tyre bead wires as well. Subsequently, in 1998, Rajratan Global entered into a technical collaboration agreement with Gustav Wolf of Germany, a renowned manufacturer of bead wires for tyres. In 2004, the company changed its name to Rajratan Global Wire Ltd. when it bought back equity held by Gustav Wolf.

Rajratan Thailand, based in Thailand, was incorporated in 2006 and specializes in the manufacture of tyre beads. It was established to serve Thailand-based clients and emerging markets. Thailand is the largest producer of rubber, making it a hub for all major tyre manufacturers.

Over the years, Raj Ratan Global Wire has established itself as a leading producer of high-quality bead wires for tyres, with a strong presence in both domestic and international markets. The company has invested in advanced technology and equipment, as well as research and development, to improve its product quality and manufacturing capabilities.

Product Details:

Tyre Bead Wires (TBW): It is also known as re-enforcement wire, and its purpose is to hold the tyre to the rim of the wheel while resisting the constant push of inflated pressure. Bead wire is the critical link that transfers the vehicle load from the rim to the tyre, preventing vibration while driving. The product improves the safety, strength, and durability of tyres. Tyres for automobiles, earth-moving equipment, aircraft, cycles, passenger vehicles, two-wheelers, three-wheelers, and truck bus radials have bead wires, that Rajratan manufactures and supply.

High Carbon Steel Wire: These are drawn steel wire (also known as black wire) made from high carbon wire rods of high quality. The product is crucial in various industries such as automotive, construction, and engineering.

Market Position

Rajratan Global is one of Asia’s largest bead wire manufacturers (excluding China). Its subsidiary, Rajratan Thailand, is the only bead wire manufacturer in Thailand and holds a 26% market share. Rajratan Global is also the largest manufacturer of TBW in India, with a 46% market share. There is a high entry barrier in the TBW industry, as it is a critical product in tyre manufacturing and the approval cycle by tyre manufacturers is long, acting as a natural barrier for new entrants.

Manufacturing Capacity

- Rajratan presently has 2 operational manufacturing plant, one in Pithampur (Indore) and one in Thailand. The company is further expanding its capacity by adding a new plant in Chennai. This plant is presently under construction and as per management ~65% of work is done (as of Dec’22). Manufacturing capacity of each plant is as below

- Pithampur (M.P.) India – 72,000 TPA

- Ratchaburi, Thailand – 60,000 TPA

- Tamil Nadu, Chennai – 60,000 TPA (Ongoing expansion)

The Chennai plant also received approval under Production Linked Incentive (PLI) Scheme from Government of India.

Clientele

Rajratan has long term relationship with some of the reputed tyre brands. It services customers in India, Italy, USA, The Czech Republic, South Korea, etc.

Indian Clients: Apollo tyres, ATG, Birla Tyres, CEAT, MRF, Balkrishna, etc.

Thailand Clients: Bridgestone, Century Tyres, Destone, etc.

International Clients: Toyo Tyres, Nankang, Trelleborg, etc.

From Q3 FY23, Rajratan has started supplying in bulk quantity to Michelin (one of the major global tyre brands). It has also started supplying for Bridgestone, Thailand, and approval for another factory of Bridgestone, Thailand also initiated.

Tax Benefit

The company’s Thailand subsidiary/division will receive tax benefit on the profits reported on all the production more than 22,000 TPA for a period of eight years. This benefit is expected to expire by 2025

Management

Mr. Sunil Chordia is the promoter and chairman of Raj Ratan Global Wire Limited. He has been leading the company since its inception in 1989 and has been with the company for over three decades. He holds a bachelor’s degree in science and an MBA in Finance.

Mr. Yashovardhan Chordia leads the Thailand business. He is the son of Mr. Sunil Chordia and joined the business in 2013. He holds a bachelor’s degree in finance and psychology from the Foundation of Liberal and Management Education (FLAME) in Pune.

The board has 4 independent directors having diverse experience and background

Shareholding

Promoters own ~65% (as of Dec’22) of the company while institutional holders (FIIs + DIIs) own ~ 8.7%. Both FIIs and DIIs have increased their ownership over the last 2 quarters, which is a positive sign. SBI Small cap fund is the largest domestic institutional investor holding ~ 7.6% of the company as per Dec’22 shareholding data.

Financial Analysis

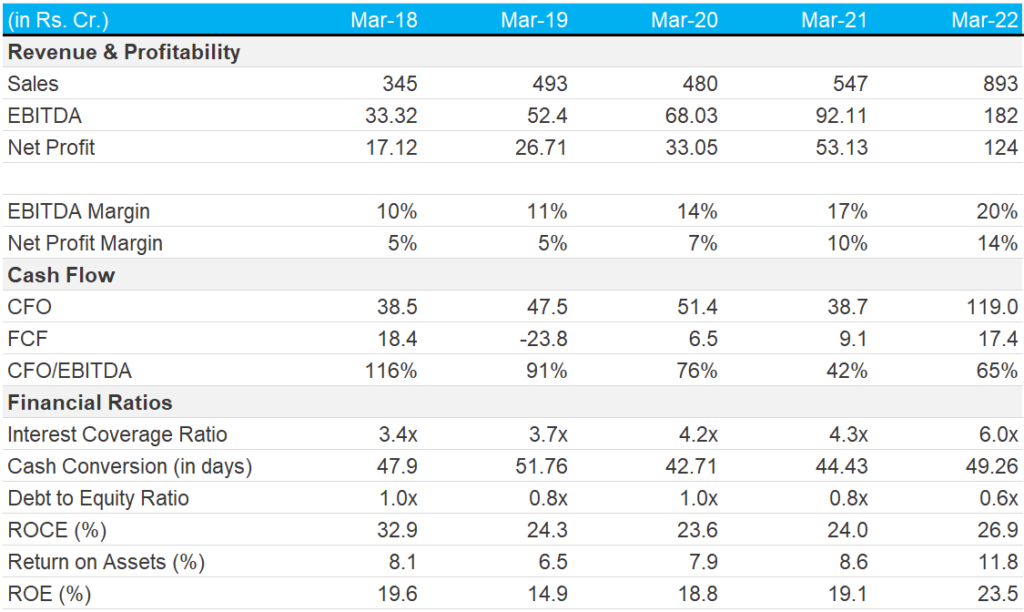

Revenue & Profitability: Rajratan Global witnessed the highest revenue and profitability in FY22. Between March 2018 and March 2022, its top line and bottom line grew at an impressive CAGR of 27% and 64%, respectively. Both EBITDA and profit margin saw consistent improvement over this period. After reaching a peak operating margin of 21% from September 2021 to June 2022, its operating margin fell to 17% in September 2022 due to a slowdown in its export business.

Cash Flow: Company has consistently been generating positive operating cash flows with a healthy cash conversion ratio. Baring FY21 which was a covid year, CFO/EBITDA ratio is healthy implying company has been able to convert its operating profit to cash.

Its debt metrics are stable and healthy. Return ratios such as ROCE and ROE are also quite good. The cash conversion cycle has increased slightly in FY22 but is still at a comfortable level. This was due to the increase in receivable days. The company has clarified that they are working with their customers to ensure timely payments. They are also exploring various banking products that allow them to make payments to their suppliers, thus reducing the stress on their balance sheet.

Business Outlook

The company’s fortune is linked to the demand for tyres, which is dependent on the automobile industry. The Indian automobile industry has gone through a difficult period over the last five years but in last 12 months, demand scenario has improved.

Thailand-based, export-oriented tyre companies that supply tyres to OEMs in the US and Europe are presently facing demand pressures due to high inflation. This has impacted the company’s earnings for the quarters ending September 2022 and December 2022. Higher energy costs and raw material price volatility also affected its margins. Demand for the India business remained stable.

During Q3FY23, average utilization for Indian plant was ~77% and that of Thailand plant was ~75%. As per management, they expect healthy volume growth of ~10 or even 15% in India but Thailand would remain muted. So overall, they have guided for 7-8% volume growth in FY23.

Despite muted volume growth for FY23, they have maintained their long-term outlook of 20% volume growth in the long term (3-5 years) which is why they are expanding their manufacturing capacity by adding a new plant in Chennai.

For the new Chennai plant, company is exploring tie ups with some European tyre companies. They have appointed a marketing manager for this who is based out of Europe.

As per company, once all 3 plants are operational and utilized, they expect revenue potential of ~ INR 1,800 crores as per current prices which is almost double of the current annual revenue. Hence, while the near-term headwinds due inflation and recession fears in US and Europe had derailed its growth trajectory, its long-term prospect looks good

Valuation

At current price, stock is trading at PE multiple of ~32x and Market cap to sales of ~4.0x. While the valuations have cooled off due to recent corrections, they’re still above their last 3-year median valuation multiples. Assuming company reaches ~80% of its peak potential revenue i.e INR 1,440 crores (peak revenue ~ INR 1,800 crores) by FY25. Net profit margin for FY22 was 14% and that for the most recent quarter was ~11%. Assuming an average net profit margin of ~12%, its net profit comes to ~ INR 173 crores. If we assume a PE multiple of ~ 30x, its market cap would be ~ INR 5,200 crores. This implies an upside potential of ~ 36% from current levels. However, if demand in the US and Europe improves, the company may deliver better numbers and stock could surprise on the upside. A good strategy would be to accumulate it through SIP route over the next 6 months and track its earnings for one or two quarters.

Key Risks:

Volatility in Raw material prices: The primary raw material utilized by the company is steel wire rods, and any fluctuations in its price can potentially affect the company’s profitability

Cyclical Industry: Tyre demand comes from Auto maker (Auto OEMs) and from replacement market. While demand from replacement market is not that cyclical, demand from OEMs is cyclical. Therefore, cyclicity of auto industry can impact its revenue and profitability

Export Market: Company’s Thailand plant is to cater to tyre manufacturing exporting to Europe and US markets. Any impact on demand in these regions (as we are seeing now due to Russia Ukraine war and high inflation) will have an adverse impact on its earnings. To address this issue, Company is increasing the wallet share in existing customers and catering to new

markets in Southeast Asia and European regions. This will help them in widening their customer base further.

Conclusion

We like the company’s market leadership position and ongoing investment plan. It has built good relationship with all major leading tyre brand which helps in getting repeat business. We also like the past record of management in capitalizing on the opportunity available. Management believes the current issues around inflation which has affected demand in the US and Europe are temporary and they have maintained long term volume growth guidance. During FY23, most Tyre companies in India have invested in their capacity expansion and facility upgrade to cater to higher demand. Rajratan will directly benefit from growth in tyre industry and therefore it can be good indirect play on both automobile sector and tyre industry.

Disclaimer: The above article is for information purposes only and should not be treated as any investment advice.