Growth at reasonable price (or GARP) is a popular investment philosophy popularized by Peter Lynch. The investment community constantly looks for a company with good growth prospects and available at reasonable valuation. In this article, we will cover one such company i.e Route Mobile Limited (“Route Mobile”) which meets the criteria of “Growth at Reasonable Price”

Route Mobile: Company Overview

Route Mobile is a cloud communications platform as a service (CPaaS) company based in Mumbai, India. The company was founded in 2004 and has been in the industry for 19 years. It provides communication platform as a service (CPaaS) solutions to enterprises, over-the-top (OTT) players, and mobile network operators (MNO). The company has a presence in more than 15 locations across the Asia-Pacific, Middle East, Africa, Europe and North America.

Route Mobile’s CPaaS platform enables businesses to send and receive messages, make and receive calls, and send and receive emails. The platform also includes features for SMS filtering, analytics, and monetization. Route Mobile’s CPaaS platform is used by businesses to:

- Send and receive marketing messages

- Provide customer support

- Enable two-factor authentication

- Collect payments

- Track user behavior

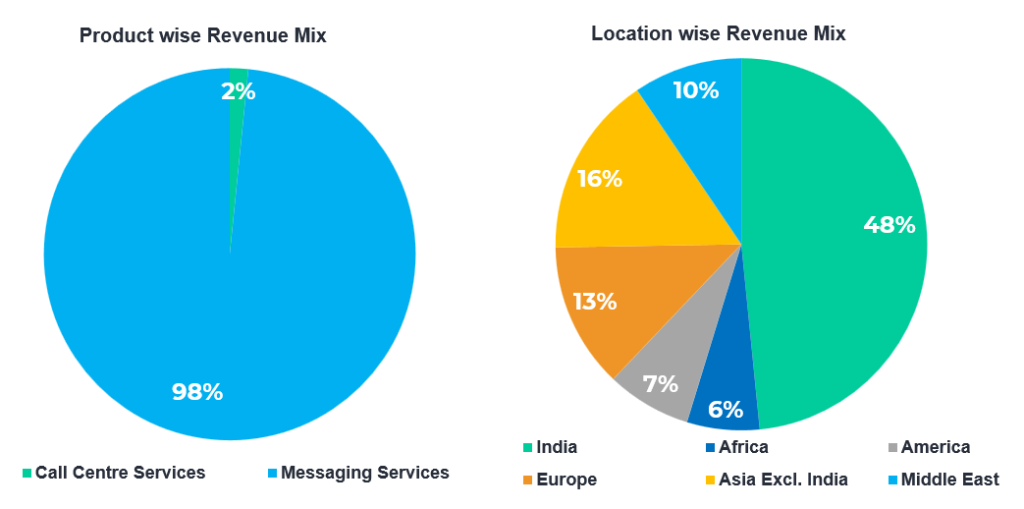

Revenue Breakup:

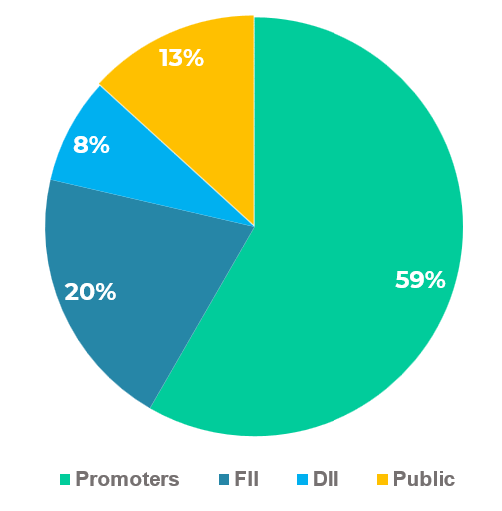

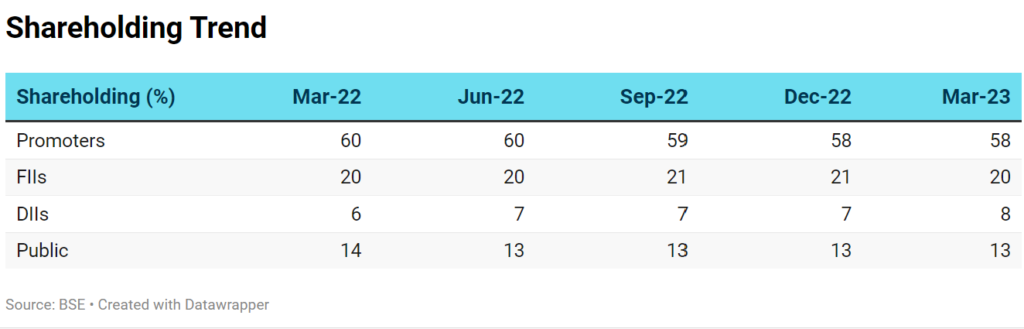

Route Mobile: Shareholding

Promoters own ~59% of the company. Institutions (i.e FII+DII combined) own ~ 28%. FIIs holding have remained nearly constant in last 4 quarters while DIIs have gradually increased their stake which is a positive sign

Route Mobile: Business Performance

Route Mobile has achieved a significant milestone, reaching an annual run rate of $0.5 billion in FY23. Despite geopolitical challenges, they have surpassed most of their guidance for the year and have achieved topline growth of 78% in FY23. The company aspires to become a billion-dollar revenue company in the next three to four years through organic and inorganic growth.

In FY23, they launched 2 new products i.e “TrueSense” and “Roubot”. TruSense is a digital identity and security service while Roubot is an integrated chatbot platform. They have established a dedicated SBU for TruSense, focusing on mobile identity and digital fraud, aiming to provide crucial insights to enterprises and mobile network operators. Additionally, they plan to establish dedicated SBUs for email, conversational bot frameworks, voice, and a virtual contact center in FY24.

Route Mobile has also secured new contracts and received awards for its cloud services and enterprise offerings. They have secured three new firewall contracts since Q3 FY23, with several other significant deals in pipeline. Additionally, they have deployed UCaaS (Unified communications as a service) solution for Robi Axiata (Bangladesh) to cater to the need of enterprise customers supporting their customer care, and marketing operations.

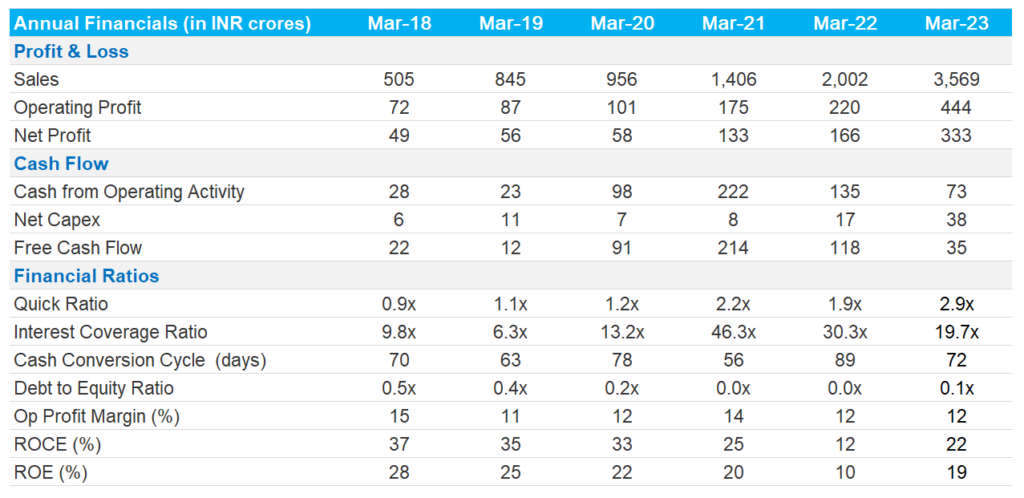

Route Mobile: Financial Overview

Route Mobile’s sales and profit have grown consistently in the last 5 years. In the last 5 years, sales have grown at an impressive CAGR of 48% over the last 5 years. In the same period its net profit has grown at a CAGR of 47%. Its operating margin has been in the range of 11-15% and lacks consistency.

Its return ratios are impressive. ROCE and ROE saw a dip in FY22 but have now improved in FY23. The company debt metrics are comfortable with interest coverage ratio at 19.7x and debt to equity at 0.1x only.

For FY23, operating revenue increased by 78%, with organic revenue growth of around 41%. Gross profit margin expanded to 22% compared to 21% in the previous year. Route mobile did a buyback in FY23 and has returned over 50% of reported PAT through dividends and buybacks to shareholders. Buyback price was ~INR 1,700 which is higher than the current market price.

The company’s CFO/EBITDA conversion ratio deteriorated in FY23. CFO/EBITDA ratio is only 16% in FY23 as compared to ~62% in previous year and more than 100% in FY21. Normalized CFO/EBITDA i.e after adjusting for security deposit for strategic business initiative is ~45%. The management in the conference call has highlighted that they remain committed to delivering normalized CFO to EBITDA conversion in the range of 50% to 75% in FY24.

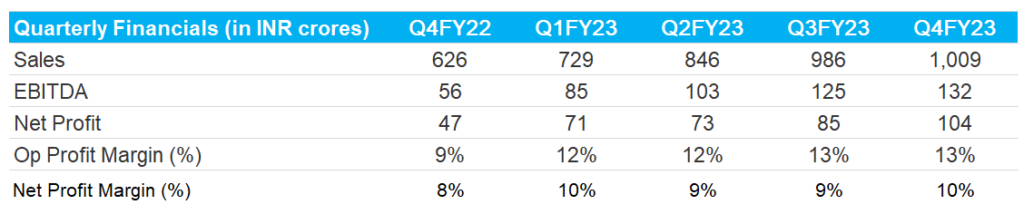

Quarterly Financial Performance

- Route Mobile reported strong revenue growth of 61% y-o-y and 2.3% Q-o-Q

- Average realization per billable transaction improved to Rs.0.37 from Rs.0.36 in Q3 FY23.

- Gross profit margin stood at 21.3% compared to 22.4% in Q3 FY23 and 21.1% in Q4 FY22.

- EBITDA increased by 91% Y-o-Y and 4% Q-o-Q, with an improved EBITDA margin.

- Adjusted profit for tax grew by 90% Y-o-Y and 19% sequentially, leading to improved PAT margins.

Route Mobile: Business Outlook

Most global enterprises are leveraging API-enabled Communications Platform as a Service (CPaaS) offerings to enhance their digital competitiveness. According to estimates, ~90% of global enterprises will use CPaaS solutions by 2026, compared to around 30% in 2022 and 20% in 2020.

The CPaaS market has clocked a strong ~34% CAGR over FY17-22 to reach USD 10.4bn in FY22 (~49% growth in FY22). As per industry experts, the CPaaS industry is set to clock ~20% CAGR over the next five years to reach ~USD 26bn in FY27E. The growth will be led by higher usage of CPaaS for enhanced customer engagement, driving business efficiencies and cross-sell opportunities. CPaaS is generally adopted by a single business unit for a particular use case like OTP, notifications, etc., and its further spreads to other business units like marketing campaigns and customer service. (Source: HDFC Securities report)

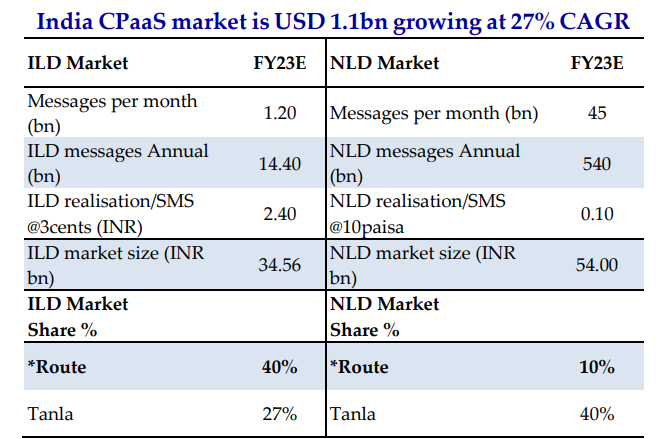

CPaaS is divided into two major segments: International Long Distance (ILD) and National Long Distance (NLD) A2P messages. As per estimates, ~1.5B A2P messages are sent in India every day, of which ~97% is NLD and ~3% is ILD. ILD messages (40% of total revenue) originate from servers located outside India and terminate in India. Route has a 40% market share in India ILD. NLD messages originate from servers in India and terminate locally. Route has a 10% market share in this segment.

The company has been focusing on further strengthening its leadership position in the cloud based CPaaS segment of the technology industry. It has enhanced its product capabilities and developed an integrated platform for multi-channel communication. Apart from A2P SMS solutions, the company also enables enterprises to leverage multiple other communication channels – including IP-based messaging channels like Whatsapp for Business, Viber, Skype, WeChat, Telegram, and a few others.

Guidance:

- Route Mobile aims to become a billion-dollar revenue company in the next three to four years with a strategic blend of organic and inorganic growth.

- The company guided for 20% growth for the next year i.e FY24.

Valuation

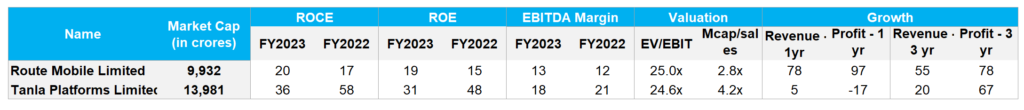

Tanla Platforms is another listed company in the same industry. So, we are comparing Route’s operating metrics and valuation with Tanla Platforms.

While Tanla has superior return rations, it witnessed degrowth in FY23. Route Mobile on the other hand reported healthy revenue and profit growth in FY23. Even on a 3-year basis, Route reported better growth both on topline and bottom line. Given the growth outlook, the valuation of Route mobile at 25 times EV/EBIT and approximately 2.8x Market cap to sales seems reasonable.

Conclusion

We prefer companies where the industry growth is expected to be 15-20% as this benefits all players. Route Mobile has demonstrated robust growth in the past, outpacing the industry. Given its technical capabilities, market positioning, we believe Route is well positioned to capitalize on the opportunities that lie ahead

Disclaimer: This article is only for information and should not be considered as any investment advice. We may have positions in these stocks in our own portfolio or have recommended it as part of our advisory services.