Shivalik Bimetal Controls Limited, (“Shivalik”), is a small cap company based in New Delhi that has delivered outstanding returns to its shareholders. It’s a true multibagger stock that has surged in value over the past 10 years by a staggering 125 times, and over the past 2 years by almost 7 times. In just 10 months, the stock has delivered a return of 116%, trading at around INR 480 after hitting a low of ~INR 222 in May 2022.

In this article, we’ll take a closer look at business model of Shivalik Bimetal Controls and future plans to assess whether this multibagger has more upside potential left. As we dive deeper into the company’s operations, we’ll explore the factors driving its impressive growth and examine the risks and challenges that could impact its future performance.

Company Overview:

Established in 1984, Shivalik Bimetal Controls Limited is a leading Indian company that specializes in the manufacture and supply of thermostatic bimetals and shunt resistors. The company has its headquarter in New Delhi and has manufacturing operations in Solan in Himachal Pradesh.

As of Mar’22, The company has two Joint Ventures. One is Shivalik Engineered Products Private Limited (SEPPL) (Formerly known as Checon Shivalik Contact Solutions Private Limited) and another one is Innovative Clad Solutions Private Limited. In April 2022, Shivali Bimetal Controls limited acquired another 50% from Checon Corporation USA. Hence, from 12th April 2022 onwards – SEPPL become the Wholly owned Subsidiary of the Shivalik Bimetal Controls Limited.

The company specializes in the joining of material through various methods such as Diffusion Bonding / Cladding, Electron Beam Welding, Solder Reflow and Resistance Welding. Its product includes “Thermostatic Bi-metal strips”, “Shunt Resistors” and “Electrical Contacts”

Thermostatic bi-metal strips are made by bonding two different metals together, usually with one metal having a higher coefficient of thermal expansion than the other. This creates a composite material with unique properties, such as the ability to bend or change shape in response to temperature changes. Bimetallic products have numerous applications across various industries, including automotive, aerospace, and consumer electronics. This product category contributed 46% of business for Shivalik Bimetals in FY22.

Shunt resistors are characterized by low temperature co-efficient, high stability of electrical resistance, low watt loss, and good heat dissipation. It finds application in energy meters, AC/DC converters, battery management systems, and electronic control units. Shunt resistors generated 52% of revenue in FY22.

Shivalik claims to be the only company in the world to offer a portfolio of Shunt Resistors, Thermostatic Bimetals, Electric contacts. The chart below provides a detailed description of its product and applications.

Geographical Presence

Shivalik has no significant domestic competition and has positioned itself to compete with global players. The company has built strong relationships with its customers and is known for its excellent customer service and technical support. In FY22, approximately 1/3rd of its business was generated from America and another 1/3rd was domestic business. Europe contributed 1/6 th of revenues while rest was from other countries.

Revenue breakup – Geography wise

Shivalik typically works with its customers from design to development stage. Customer approval across end industries is a lengthy process (3-5 years) and this acts as a natural barrier to entry for competitors

Manufacturing Process

There are 2 major types of bonding processes in use today for thermostatic bi-metal products. Most of the industry uses a cold bonding process which requires a subsequent sintering operation to drive oxides and other impurities away from the metal interfaces to improve the bond. Shivalik, on the other hand, uses cladding technology called continuous hot bonding which relies on more heat and less pressure than conventional methods. This process also results in long coils of material without welds and with excellent bond integrity. Prior to final processing, the coils weigh upto 60 kg per centimetre of width.

Shunt resistors are manufactured using electron beam welding technology. SBC has an integrated manufacturing capability which extends from designing to bulk production. SBC exports its products to countries around the world and has a strong presence in the global bimetallic products market.

Manufacturing Facilities

Shivalik has 3 manufacturing plants in Solan, Himachal Pradesh, one each for manufacturing of Shunt Resistors, Thermostatic Bimetal strips and Electrical contacts. The company is doing capacity expansion. As per company, total revenue potential post the completion of expansion is approximately ~ INR 1600 crores.

Management

There is an experienced management and board at helm of Shivalik Bi-metal Controls. It is led by SS Sandhu who has been leading the company for last 5 decades. Under his leadership, the company has expanded its product range, invested in R&D, and established a strong presence in the global market. During his tenor, Shivalik has received multiple accolades from customers such as Schneider, Siemens, L&T and Legrand.

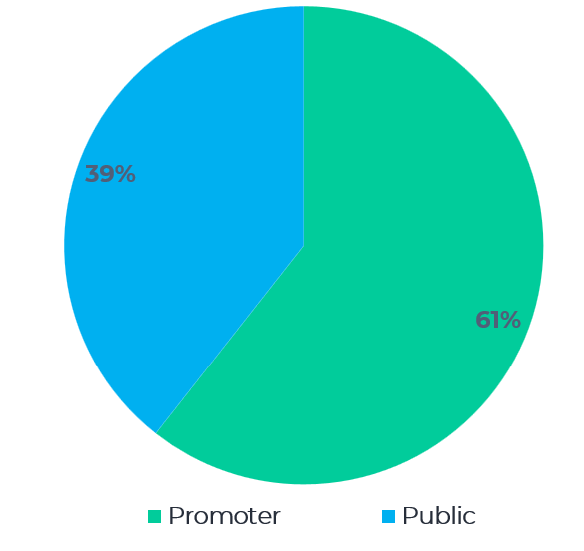

Shareholding

Promoters own almost 60% of the business. However, the institutional holding is very low at 0.3%. This is probably a reflection of the market capitalization which is about INR 2,000 crores only.

Financial Analysis

Revenue & Profitability

Shivalik’s top line and bottom-line growth have been quite impressive with revenue growing at ~20% CAGR during Mar-18 to Mar-22. In the same period, net profit grew at ~35% CAGR. Operating margins have also seen consistent improvement. This growth in revenue and profitability is a result of the consistent increase in the share of shunt resistors, which are used in battery management systems (BMS).

This product segment is expected to continue growing on the back of increasing penetration of electric vehicles. The company is further expanding its manufacturing capacity to address the growing demand.

Cash Flows:

While Shivalik’s top line and bottom-line growth have been quite impressive, its cash flows are telling a different story. The company is not able to convert its operating profit into cash. In the last 5 years, cumulative CFO is only ~INR 78 crores as against cumulative EBITDA of INR 291 crores. This implies a cash conversion ratio of only ~ 35% in the last 5 years, which is quite poor. Cumulative 5-year free cash flows (FCF) are only INR 14 crores.

Key Financial Ratios:

Shivalik’s debt metrics are quite good. While debt to equity ratio has deteriorated y-o-y, it remains comfortable at only ~0.3x. Return ratios like ROCE and ROE are quite impressive. Growth in ROE is led by profit growth and not leverage.

Investors should take note of another important aspect of Shivalik’s finances. The company depreciates the useful life of its plant and machinery over a period of 15-30 years. This appears longer than usual for such assets. This could result in an overstatement of the company’s profits.

Business Outlook

Shivalik’s shunt resistors are a critical component used in battery management systems of electric vehicles, making them an integral part of the global EV adoption theme. With the growing demand for electric vehicles worldwide, the demand for Shivalik’s shunt resistors is expected to increase. As per company, total global addressable market for their shunt resistors was $1.23 billion in FY 2022, which is projected to grow at a CAGR of ~9% to $2.4 billion by FY 2030.

Shivalik has already established itself as a preferred supplier for many global companies and has successfully penetrated markets outside of India. Its customers recognize them as their preferred suppliers, and they have received numerous awards and accolades from key customers such as Siemens, Legrand, and Schneider.

Currently, Shivalik’s annual revenue is ~ INR 324 crores, but once their ongoing expansion is completed, their revenue potential will increase to ~ INR 1,600 crores. This is expected to play out over the next few years (3-4 years), making it a worthwhile investment case.

Valuation

Shivalik is currently trading at a multiple of ~40x its last 12 months’ earnings, which is not cheap. There is limited room for any re-rating. However, with new expansion coming along and increasing adoption of electric vehicles, it can continue its growth trajectory. Shivalik doesn’t have any significant competitors in India and therefore its valuation cannot be directly compared. Given this, and growth potential, it may continue to trade at a premium. Hence, investors should consider buying it on correction to get good margin of safety. Its cash flows remain a drag and an investor needs to track this closely.

Technically, it’s trading at ~ INR 480 which is close to its all-time high (of ~ INR 500). Momentum investors/traders can take position on breakout above this level.

Risks

Shivalik Bimetal Controls Limited faces a few risks that investors should be aware of. The company has a net exposure of around USD 2.3 million, which could result in losses if INR depreciates. Additionally, the prices of nickel and copper, which are the primary raw materials used by the company, are prone to fluctuations. Such volatility could adversely impact the company’s profitability. Lastly, Shivalik generates a significant portion of its income from overseas. Any disruption in the global supply chain could potentially affect its financials negatively. Investors should keep an eye on these risks and how the company manages them.

Disclaimer: Please note that the above article is for informational purposes only and does not constitute investment advice.